IPPEX Cloud V 1.27 Release Notes

Introduction

Version 1.27 extends the systems pre-processing capability with the introduction of a flexible changes report. The added features improve the way users review the changes data and enabling organisations to structure their data for upload to the local provider’s gross to net system.

A new multi-payroll and multi-period starter and leaver report, which lists all the starters, leavers and the active employees over the reporting time period.

A number of enhancements have been made to a number of reports, for example adding totals to variance reports, and removing data columns which only contain nulls.

Upload control panel

The payroll menu has been streamlined, removing the sub-menu for upload and promoting the upload control panel to the main payroll menu. All the upload functions are available through the upload control panel. Please note the combined upload brings together employee record, address, bank, employee details and organisation units into a single upload. The separate uploads for employee, address and bank details are still available at the bottom of the upload control panel.

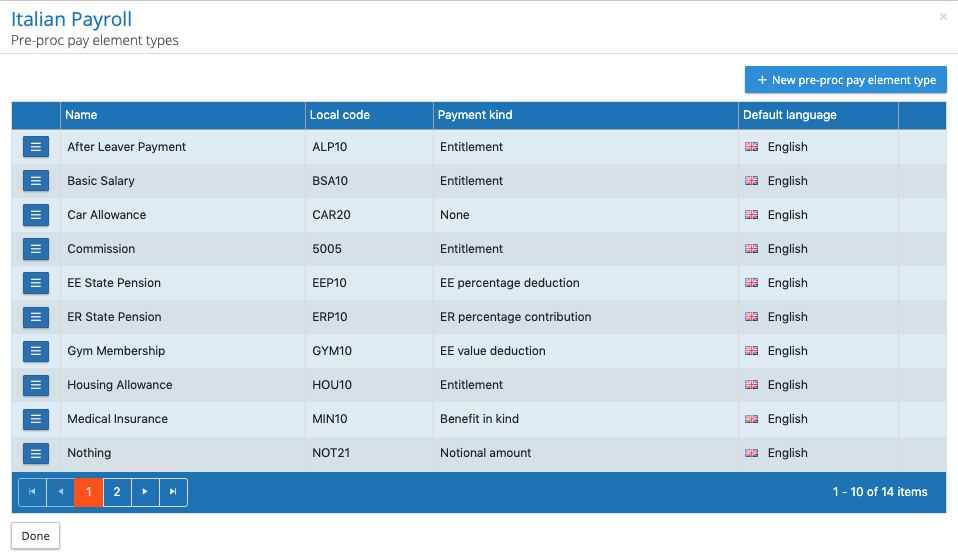

Local Code and Payment Kind

Pre-processing pay elements and employee details can be given an alternative name or code, this new function is called Local Code. When using the flexible changes report there is an option to replace the pre-processing pay element name or employee detail name with the corresponding local code. This enables the report to contain elements that will match the upload system requirements of the gross to net software.

When a pre-processing pay element or employee detail is being created, it is given a name in the IPPEX and an optional field where the local code can also be given. A local code can be added or amended after the element or detail has been created. From the payroll list, go to pay data then pre-processing pay elements, selecting edit function to amend the pay element.

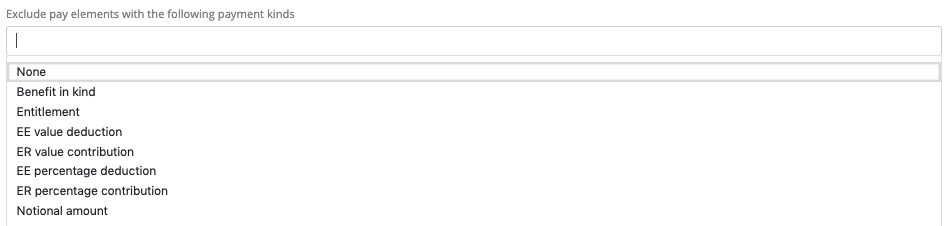

Pay elements can be given a payment kind, this describes the purpose of the pay element, the options are as follows:

- None

- Benefit in kind

- Entitlement

- EE value deduction

- ER value contribution

- EE percentage deduction

- ER percentage contribution

- Notional Amount

When a pay element is being created, there is an option to select one of the above ‘kinds’ to describe the purpose. From the payroll menu, select pay data, pay element types and pre-processing, the system will list of the pre-processing pay elements, including the local code and payment kind.

Click on the edit button next to the pay element to add or edit the local code and payment kind.

Flexible Changes Report

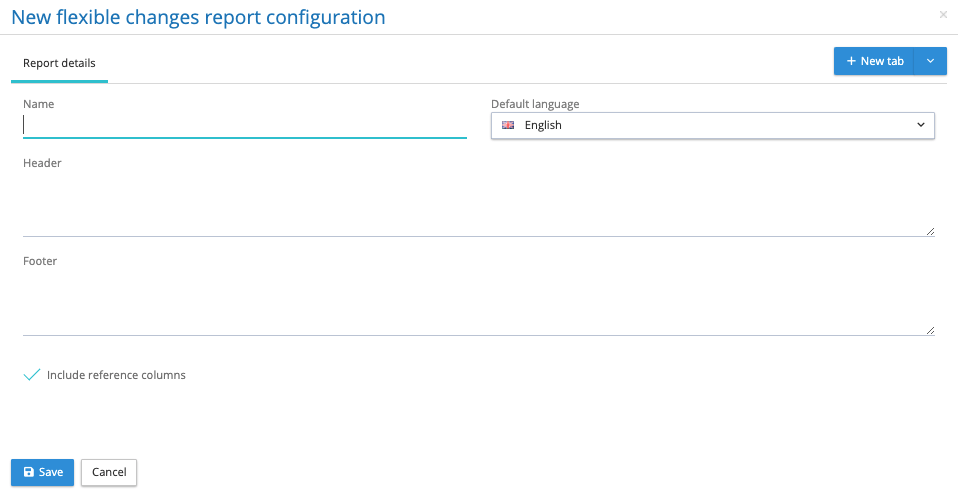

The flexible changes report provides users with the ability to configure a report in a variety of formats and to utilise a set of filters to ensure only the data needed is contained within the report. The following describes the building blocks and features contained in the report.

From the payroll menu, against the payroll go to reporting and then configurations selecting the flexible changes report.

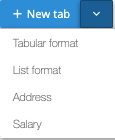

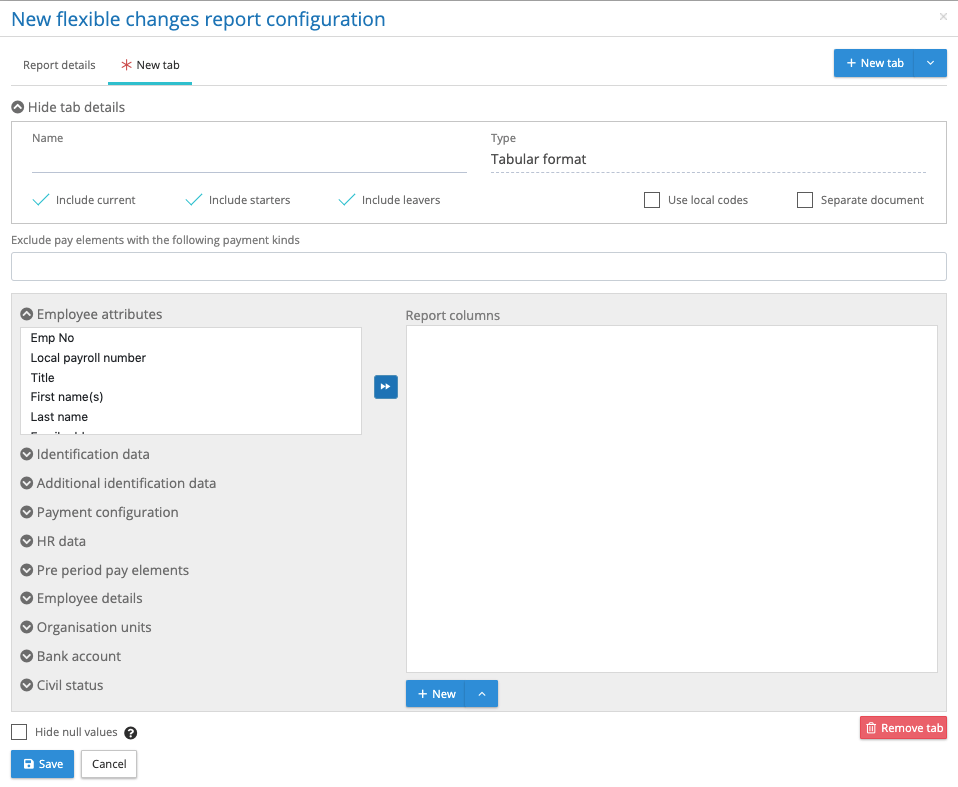

It is mandatory to give the report a name. The next step is to add sheets or separate files to the report, any number of these can be added. Click on the drop-down arrow next to the +New Tab. This offers four choices.

- Tabular format – A tabular report is made up of a column heading and one row per employee detailing the changes for employee record information, organisation units, pre-processing period pay elements and employee details for those items that have been selected.

- List format – A list report is where the element names (pre-processing period or permanent pay elements, organisation units and employee details) are contained in a single column and the values are shown in another column.

- Address – This is a list output detailing all of the employees with address changes.

- Salary – This is a list output detailing all of the employees with a salary change.

Tabular Format

How to configure the tabular report:

Name – The new sheet/file requires a name. If the output is a separate file, the file name will be a combination of the report name and tab name.

Include – Current, starters and leavers – This is a filter, for current it will include all those employees who are not showing a payroll start date or payroll leave date within this changes reporting period. Include starters are those employees with a payroll start date in the reporting period and include leavers are employees with a payroll leave date in this reporting period.

Use Local codes – This is a check box, when checked the pay element names are replaced with the local codes for each of the pre-processing pay elements and employee details. Where a local code has not been specified for an element the system will enter the element name in square brackets, this indicates a local code is needed for this element.

Separate Document – This is a check box, when checked the tab configuration will report as a separate file.

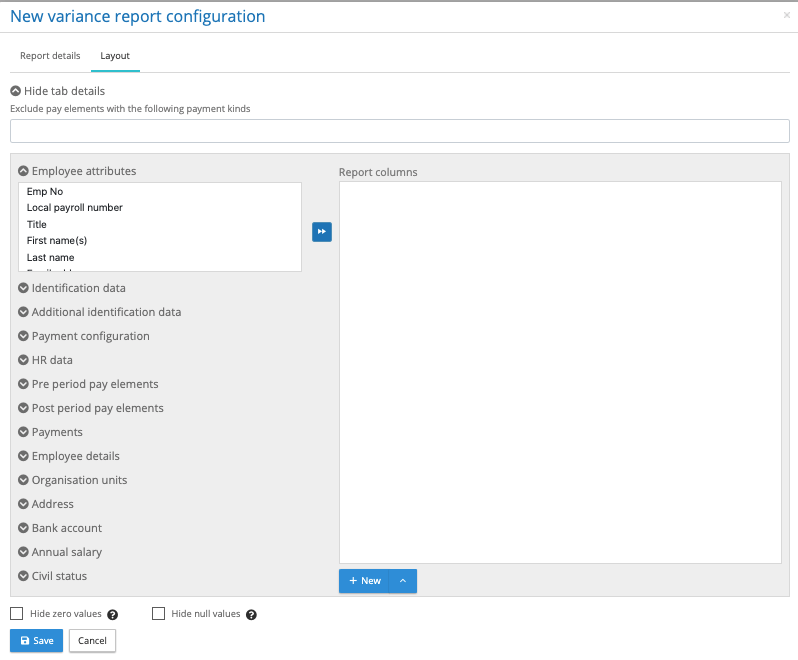

Exclude pay elements with the following payment kinds – Click on the box below the heading, it will show of list of pay element kinds that could be excluded from the report. Incrementally add payment element kinds to be excluded, as each one is added the list of permissible values will change in the pre-processing period pay elements.

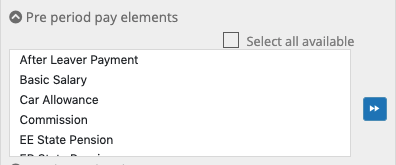

Select all available – For period pre-processing pay elements, employee details and organisation units there is a check box option called ‘Select all available’. For the pre-processing pay elements, this works in conjunction with the ‘Exclude pay elements with the following payment kinds’. If a new element is created for that payroll, that is within the list of payment kinds selected for that report, the system will add the new element to the end of the report columns. This ensures nothing is missed in the changes report.

Hide null values – At the bottom of the report configurator is a checkbox called hide null values. This will remove any columns from the report where the results for a given pay element are nulls for all the employees (no value). Please note a zero is regarded as a value.

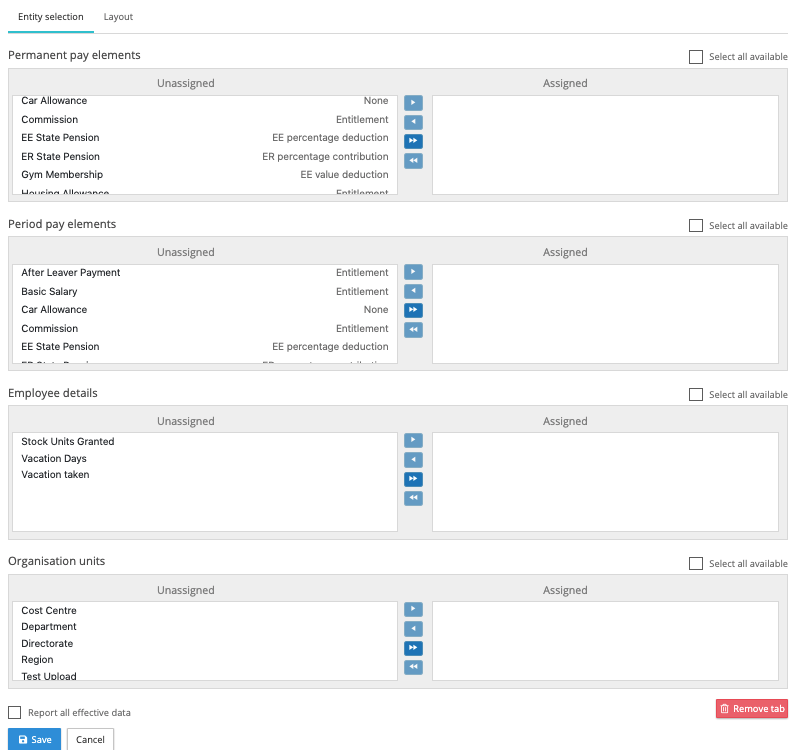

List Format

This shares the following features as found in the tabular report: Name, include current/starters/leavers, exclude pay elements with the following payment kinds, use local codes, separate document and select all available. This report is restricted to permanent pay elements, period pay elements, employee details and organisation units.

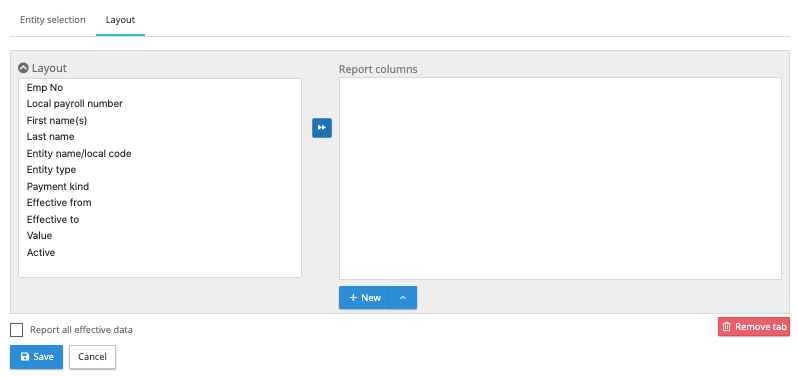

There are two parts to the configuration, entity selection and layout.

Entity selection – Select the pay elements, employee details and organisation units needed in the report. Please note the pay elements work in conjunction with Exclude pay elements with the following payment kinds and the employees contained in the report will be determined by the include current/starters/leavers filters.

Layout – From the left-hand layout list select the reporting columns.

Report all effective data – This checkbox extends the permanent pay element reporting to include those elements that are currently effective for this pay period, which is those that have an effective end date that is between or greater than the two pay dates (from period and to period), and the effective from date is before or between the two pay dates (from period and to period).

Address and Salary Tabs

These are similar to the existing changes reports, with the addition of including the local payroll number in the report structure.

Running a flexible changes report

The kick-off process is identical to the standard changes report, from the payroll menu using the action button next to the payroll, select reporting and flexible changes report. Select the report configuration, then the to period and whether you want full employee list or only employees with changes and click on generate report.

Quarterly and Yearly Pay Frequencies

Two new pay frequencies have been added to the payroll frequencies, quarterly and yearly. The set-up process of a payroll with one of these two new frequencies is like that of a monthly payroll. When creating a new payroll under the pay frequency there are two new options in the drop-down menu.

Variance Report Enhancements

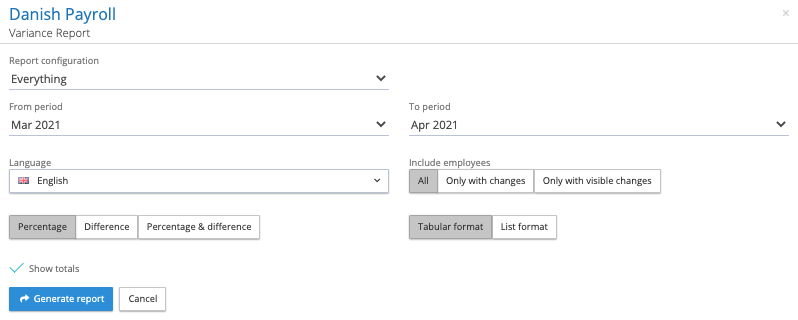

There are three new features within the configuration of a variance report and two new report kick-off options.

New variance report configuration options

Exclude pay elements with the following payment kinds – Click on the box below this heading, it will show of list of pre-processing pay element kinds that could be excluded from the report. Incrementally add payment element kinds to be excluded, as each one is added the list of permissible values will change in the pre-processing period pay elements.

Hide Null Values – At the bottom of the report configurator is a checkbox called hide null values. This will remove any columns from the tabular report where all of the results for a given pay element are nulls (no value) in both the from period and to period. Please note a zero is regarded as a value. For the list report any employee with a pay element a null value will be excluded from the report.

Hide zero values – At the bottom of the report configurator is a checkbox called hide zero values. This will remove any columns from the tabular report where all of the results for a given pay element are zero in both the from period and to period. For the list report any employee with a pay element holding a zero value will be excluded from the report.

Variance report kick-off enhancements

Include Employees – There are three choices

All – The report will include all active employees.

Only with changes – It will include all employees that have a change in value for any of the selected or unselected pay elements for that payroll for that pay period.

Only visible change – It will include all employees that have a change in value for only those selected pay elements requested in the report for that payroll and pay period

Show totals – For the tabular report add totals to the pay element columns.

All Data Report Enhancement

The All Data report configurator has two new features:

Hide Null Values – At the bottom of the report configurator is a checkbox called hide null values. This will remove any columns from the report where all of the results for a given pay element are nulls (no value). Please note a zero is regarded as a value.

Hide zero values – At the bottom of the report configurator is a checkbox called hide zero values. This will remove any columns from the report where all of the results for a given pay element are zero.

Starters and Leavers Report

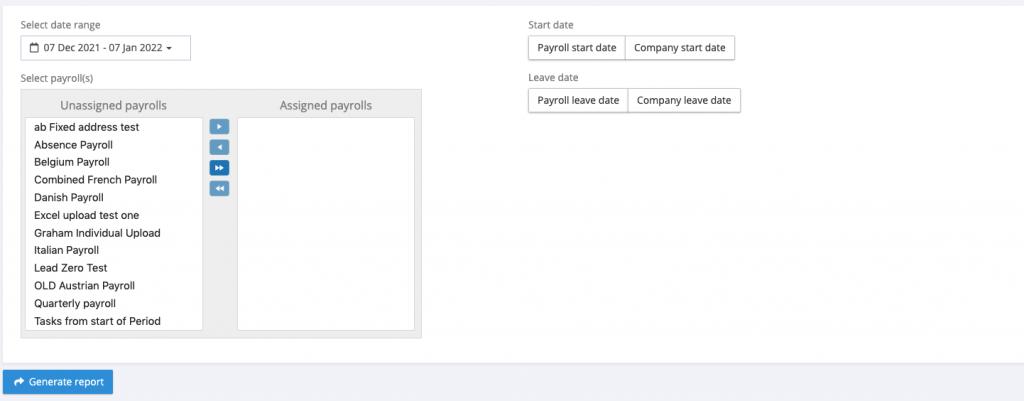

Introduction of a new multi-payroll and multi-period transaction report, from the main menu go to Reports, under transactional is a starters/leaver report.

Select date range – Select the time period for the report, any start date or leave date falling within the range will be included in the report

Assign payrolls – Select the payrolls to be included in the report.

Start date – Choose which employee field is to used to include the starters

Leave date – Chose which employee field is to used to include the leavers